[vc_row type=”vc_default” full_width=”stretch_row_content_no_spaces” css=”.vc_custom_1500547593342{padding-right: 100px !important;}” el_class=”noPaddinRow”][vc_column width=”1/6″ el_class=”noPaddingLeft” offset=”vc_hidden-md vc_hidden-sm vc_hidden-xs”][vc_raw_html]JTNDZGl2JTIwY2xhc3MlM0QlMjJtYWluLXN0cmlwJTIyJTNFJTBBJTNDZGl2JTIwY2xhc3MlM0QlMjJibHVlLXN0cmlwMCUyMiUzRSUzQyUyRmRpdiUzRSUwQSUzQ2RpdiUyMGNsYXNzJTNEJTIyYmx1ZS1zdHJpcDElMjIlM0UlM0MlMkZkaXYlM0UlMEElM0NkaXYlMjBjbGFzcyUzRCUyMmJsdWUtc3RyaXAyJTIyJTNFJTNDJTJGZGl2JTNFJTBBJTNDJTJGZGl2JTNF[/vc_raw_html][/vc_column][vc_column width=”5/6″ el_class=”justifyText” css=”.vc_custom_1530195741159{padding-right: 310px !important;}” offset=”vc_hidden-md vc_hidden-sm vc_hidden-xs”][vc_empty_space height=”50px”][vc_column_text]

[/vc_column_text][vc_empty_space height=”30px”][vc_row_inner el_id=”newsletters”][vc_column_inner width=”1/6″][/vc_column_inner][vc_column_inner width=”2/3″][vc_custom_heading text=”Should Nigeria Look Inward?” font_container=”tag:h1|font_size:22|text_align:justify|color:%236699cc|line_height:1.8″ use_theme_fonts=”yes”][/vc_column_inner][vc_column_inner width=”1/6″][/vc_column_inner][/vc_row_inner][vc_empty_space height=”25px”][vc_column_text]

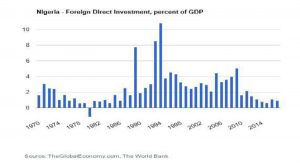

To understand the chart below, we need to first define the basic concepts: ‘’FDI’’ and ‘’GDP’’. Foreign direct investment (FDI) is defined as any investment in a country that gives a foreign investor at least 10% ownership of a local company operating in any sector. FDI is reported on an annual basis, i.e. how much new investment was received into the country during the current year less money taken out (divestments). Gross Domestic Product (GDP) measures the value of economic activity within a country as the sum of the market values, or prices, of all final goods and services produced in an economy during a period. The chart shows the relationship between FDI and GDP, simply net inflows (new investment inflows less divestment) from foreign investors into Nigeria divided by Nigeria’s GDP.

The data shows that between 1970 to 2017, FDI into Nigeria averaged 2.54 % of GDP with a minimum of 1.15% in 1980 and a maximum of 10.83% in 1994. As at 2017 it was about 1.5%. To put this in comparative context, the top 3 countries for FDI to GDP ratio are Hungary 55+%, Luxembourg 45+%, Hong Kong 41+%. Hungary has a low average GDP growth of 0.5%, whilst Luxembourg and Hong Kong are financial havens with little internal production and high dependence on FDI’s. To further contextualize this, public data shows that thriving economies like Canada and America are just above 2% in FDI to GDP ratio. This means it is not an adverse situation that Nigeria’s FDI to GDP ratio is under 2%. India, one of the fastest growing economies has a ratio of 1.95%. It means that Nigerians by themselves are responsible for creating <> 97% of our internally generated income as a country. How significant is the fact that Nigerians are in the driver’s seat of the Nigerian economy?

I am of the view that most countries have an economic thrust that leans towards either a free market open-door foreign investment policy or a protective mechanism for stable home-grown entrepreneurship. Countries realize that trying to pursue the two in a wholesome manner does lead to certain conflicts as in certain regards they can be diametrically opposed. Therefore, most countries lean more in either direction. Donald Trump for example says ‘’America First’’ and has created jobs. Ireland entices foreign investors via 12.5% corporate taxes and its open doors but also creates jobs. Where does Nigeria lean?

From the chart, it is obvious that Nigeria is endowed with human and natural resources to grow an economy that is not dependent on FDI. It is also obvious that FDI is not a likely solution to our unemployment problem or our poverty index unless we grow it exponentially over the next few years. The chart buttresses my view that we need to look inwards, decide what is important to Nigerians, and find a core philosophy that leverages on domestically available resources. Let me share with you about Bhutan, one of the smallest countries in the world, population about 800,000, which is currently rated as the 3rd fastest growing economy in the world. Note that their FDI/GDP ratio is 0.36% so FDI is not responsible for its growth. What is most interesting about Bhutan is its underlying philosophy that drives economic policies. In 1972 the 4th King of Bhutan, King Jigme Singye Wangchuck, coined the phrase ‘gross national happiness’ when he declared, “Gross National Happiness is more important than Gross Domestic Product.” Since then the idea of Gross National Happiness (GNH) has influenced Bhutan’s economic and social policy and captured the imagination of others far beyond its borders. In creating the Gross National Happiness Index, Bhutan sought to create a measurement tool that would be useful for policymaking and create policy incentives for the governmentand businesses of Bhutan to increase GNH. The GNH Index includes both traditional areas of socio-economic concern such as living standards, health and education and less traditional aspects of culture and psychological wellbeing. It is a holistic reflection of the general wellbeing of the Bhutanese population rather than a subjective psychological ranking of ‘happiness’ alone. Today, in South Asia, Bhutan ranks first in economic freedom, ease of doing business, and peace; second in per capita income; and is the least corrupt country as of 2016. Bhutan continues to be a least developed country and has its problems, but it has set the parameters for driving policy and achieving year on year results.

What central philosophy drives Nigeria’s socioeconomic policies? Don’t you think Nigeria needs to look inward and decide what is important to Nigerians? Shall we continue to dither and ride on clichés that have minimal socio-economic effect on our citizens?

[/vc_column_text][/vc_column][/vc_row][vc_row type=”vc_default” full_width=”stretch_row_content_no_spaces” css=”.vc_custom_1500547593342{padding-right: 100px !important;}” el_class=”noPaddinRow”][vc_column el_class=”noPaddingLeft” offset=”vc_hidden-lg vc_hidden-xs”][vc_raw_html]JTNDZGl2JTIwY2xhc3MlM0QlMjJ0YWItbWFpbi1zdHJpcCUyMiUzRSUwQSUzQ2RpdiUyMGNsYXNzJTNEJTIydGFiLWJsdWUtc3RyaXAwJTIyJTNFJTNDJTJGZGl2JTNFJTBBJTNDZGl2JTIwY2xhc3MlM0QlMjJ0YWItYmx1ZS1zdHJpcDElMjIlM0UlM0MlMkZkaXYlM0UlMEElM0NkaXYlMjBjbGFzcyUzRCUyMnRhYi1ibHVlLXN0cmlwMiUyMiUzRSUzQyUyRmRpdiUzRSUwQSUzQyUyRmRpdiUzRQ==[/vc_raw_html][vc_empty_space height=”25px”][vc_row_inner][vc_column_inner width=”1/6″][/vc_column_inner][vc_column_inner width=”2/3″][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Should Nigeria Look Inward?” font_container=”tag:h1|font_size:22|text_align:justify|color:%236699cc|line_height:1.8″ use_theme_fonts=”yes”][vc_column_text]

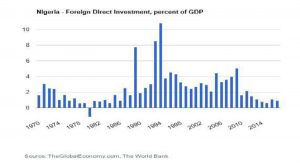

To understand the chart below, we need to first define the basic concepts: ‘’FDI’’ and ‘’GDP’’. Foreign direct investment (FDI) is defined as any investment in a country that gives a foreign investor at least 10% ownership of a local company operating in any sector. FDI is reported on an annual basis, i.e. how much new investment was received into the country during the current year less money taken out (divestments). Gross Domestic Product (GDP) measures the value of economic activity within a country as the sum of the market values, or prices, of all final goods and services produced in an economy during a period. The chart shows the relationship between FDI and GDP, simply net inflows (new investment inflows less divestment) from foreign investors into Nigeria divided by Nigeria’s GDP.

The data shows that between 1970 to 2017, FDI into Nigeria averaged 2.54 % of GDP with a minimum of 1.15% in 1980 and a maximum of 10.83% in 1994. As at 2017 it was about 1.5%. To put this in comparative context, the top 3 countries for FDI to GDP ratio are Hungary 55+%, Luxembourg 45+%, Hong Kong 41+%. Hungary has a low average GDP growth of 0.5%, whilst Luxembourg and Hong Kong are financial havens with little internal production and high dependence on FDI’s. To further contextualize this, public data shows that thriving economies like Canada and America are just above 2% in FDI to GDP ratio. This means it is not an adverse situation that Nigeria’s FDI to GDP ratio is under 2%. India, one of the fastest growing economies has a ratio of 1.95%. It means that Nigerians by themselves are responsible for creating <> 97% of our internally generated income as a country. How significant is the fact that Nigerians are in the driver’s seat of the Nigerian economy?

I am of the view that most countries have an economic thrust that leans towards either a free market open-door foreign investment policy or a protective mechanism for stable home-grown entrepreneurship. Countries realize that trying to pursue the two in a wholesome manner does lead to certain conflicts as in certain regards they can be diametrically opposed. Therefore, most countries lean more in either direction. Donald Trump for example says ‘’America First’’ and has created jobs. Ireland entices foreign investors via 12.5% corporate taxes and its open doors but also creates jobs. Where does Nigeria lean?

From the chart, it is obvious that Nigeria is endowed with human and natural resources to grow an economy that is not dependent on FDI. It is also obvious that FDI is not a likely solution to our unemployment problem or our poverty index unless we grow it exponentially over the next few years. The chart buttresses my view that we need to look inwards, decide what is important to Nigerians, and find a core philosophy that leverages on domestically available resources. Let me share with you about Bhutan, one of the smallest countries in the world, population about 800,000, which is currently rated as the 3rd fastest growing economy in the world. Note that their FDI/GDP ratio is 0.36% so FDI is not responsible for its growth. What is most interesting about Bhutan is its underlying philosophy that drives economic policies. In 1972 the 4th King of Bhutan, King Jigme Singye Wangchuck, coined the phrase ‘gross national happiness’ when he declared, “Gross National Happiness is more important than Gross Domestic Product.” Since then the idea of Gross National Happiness (GNH) has influenced Bhutan’s economic and social policy and captured the imagination of others far beyond its borders. In creating the Gross National Happiness Index, Bhutan sought to create a measurement tool that would be useful for policymaking and create policy incentives for the governmentand businesses of Bhutan to increase GNH. The GNH Index includes both traditional areas of socio-economic concern such as living standards, health and education and less traditional aspects of culture and psychological wellbeing. It is a holistic reflection of the general wellbeing of the Bhutanese population rather than a subjective psychological ranking of ‘happiness’ alone. Today, in South Asia, Bhutan ranks first in economic freedom, ease of doing business, and peace; second in per capita income; and is the least corrupt country as of 2016. Bhutan continues to be a least developed country and has its problems, but it has set the parameters for driving policy and achieving year on year results.

What central philosophy drives Nigeria’s socioeconomic policies? Don’t you think Nigeria needs to look inward and decide what is important to Nigerians? Shall we continue to dither and ride on clichés that have minimal socio-economic effect on our citizens?

[/vc_column_text][/vc_column_inner][vc_column_inner width=”1/6″][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row][vc_row type=”vc_default” full_width=”stretch_row_content_no_spaces” css=”.vc_custom_1500547593342{padding-right: 100px !important;}” el_class=”noPaddinRow”][vc_column el_class=”noPaddingLeft” offset=”vc_hidden-lg vc_hidden-md vc_hidden-sm” css=”.vc_custom_1533215258743{padding-right: 75px !important;padding-left: 60px !important;}”][vc_raw_html]JTNDZGl2JTIwY2xhc3MlM0QlMjJtb2ItbWFpbi1zdHJpcCUyMiUzRSUwQSUzQ2RpdiUyMGNsYXNzJTNEJTIybW9iLWJsdWUtc3RyaXAwJTIyJTNFJTNDJTJGZGl2JTNFJTBBJTNDZGl2JTIwY2xhc3MlM0QlMjJtb2ItYmx1ZS1zdHJpcDElMjIlM0UlM0MlMkZkaXYlM0UlMEElM0NkaXYlMjBjbGFzcyUzRCUyMm1vYi1ibHVlLXN0cmlwMiUyMiUzRSUzQyUyRmRpdiUzRSUwQSUzQyUyRmRpdiUzRQ==[/vc_raw_html][vc_empty_space height=”25px”][vc_row_inner][vc_column_inner width=”1/6″][/vc_column_inner][vc_column_inner width=”2/3″][vc_column_text]

[/vc_column_text][vc_custom_heading text=”Should Nigeria Look Inward?” font_container=”tag:h1|font_size:22|text_align:justify|color:%236699cc|line_height:1.8″ use_theme_fonts=”yes”][vc_column_text]

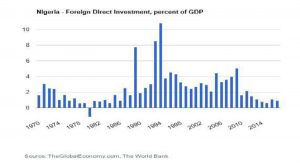

To understand the chart below, we need to first define the basic concepts: ‘’FDI’’ and ‘’GDP’’. Foreign direct investment (FDI) is defined as any investment in a country that gives a foreign investor at least 10% ownership of a local company operating in any sector. FDI is reported on an annual basis, i.e. how much new investment was received into the country during the current year less money taken out (divestments). Gross Domestic Product (GDP) measures the value of economic activity within a country as the sum of the market values, or prices, of all final goods and services produced in an economy during a period. The chart shows the relationship between FDI and GDP, simply net inflows (new investment inflows less divestment) from foreign investors into Nigeria divided by Nigeria’s GDP.

The data shows that between 1970 to 2017, FDI into Nigeria averaged 2.54 % of GDP with a minimum of 1.15% in 1980 and a maximum of 10.83% in 1994. As at 2017 it was about 1.5%. To put this in comparative context, the top 3 countries for FDI to GDP ratio are Hungary 55+%, Luxembourg 45+%, Hong Kong 41+%. Hungary has a low average GDP growth of 0.5%, whilst Luxembourg and Hong Kong are financial havens with little internal production and high dependence on FDI’s. To further contextualize this, public data shows that thriving economies like Canada and America are just above 2% in FDI to GDP ratio. This means it is not an adverse situation that Nigeria’s FDI to GDP ratio is under 2%. India, one of the fastest growing economies has a ratio of 1.95%. It means that Nigerians by themselves are responsible for creating <> 97% of our internally generated income as a country. How significant is the fact that Nigerians are in the driver’s seat of the Nigerian economy?

I am of the view that most countries have an economic thrust that leans towards either a free market open-door foreign investment policy or a protective mechanism for stable home-grown entrepreneurship. Countries realize that trying to pursue the two in a wholesome manner does lead to certain conflicts as in certain regards they can be diametrically opposed. Therefore, most countries lean more in either direction. Donald Trump for example says ‘’America First’’ and has created jobs. Ireland entices foreign investors via 12.5% corporate taxes and its open doors but also creates jobs. Where does Nigeria lean?

From the chart, it is obvious that Nigeria is endowed with human and natural resources to grow an economy that is not dependent on FDI. It is also obvious that FDI is not a likely solution to our unemployment problem or our poverty index unless we grow it exponentially over the next few years. The chart buttresses my view that we need to look inwards, decide what is important to Nigerians, and find a core philosophy that leverages on domestically available resources. Let me share with you about Bhutan, one of the smallest countries in the world, population about 800,000, which is currently rated as the 3rd fastest growing economy in the world. Note that their FDI/GDP ratio is 0.36% so FDI is not responsible for its growth. What is most interesting about Bhutan is its underlying philosophy that drives economic policies. In 1972 the 4th King of Bhutan, King Jigme Singye Wangchuck, coined the phrase ‘gross national happiness’ when he declared, “Gross National Happiness is more important than Gross Domestic Product.” Since then the idea of Gross National Happiness (GNH) has influenced Bhutan’s economic and social policy and captured the imagination of others far beyond its borders. In creating the Gross National Happiness Index, Bhutan sought to create a measurement tool that would be useful for policymaking and create policy incentives for the governmentand businesses of Bhutan to increase GNH. The GNH Index includes both traditional areas of socio-economic concern such as living standards, health and education and less traditional aspects of culture and psychological wellbeing. It is a holistic reflection of the general wellbeing of the Bhutanese population rather than a subjective psychological ranking of ‘happiness’ alone. Today, in South Asia, Bhutan ranks first in economic freedom, ease of doing business, and peace; second in per capita income; and is the least corrupt country as of 2016. Bhutan continues to be a least developed country and has its problems, but it has set the parameters for driving policy and achieving year on year results.

What central philosophy drives Nigeria’s socioeconomic policies? Don’t you think Nigeria needs to look inward and decide what is important to Nigerians? Shall we continue to dither and ride on clichés that have minimal socio-economic effect on our citizens?

[/vc_column_text][/vc_column_inner][vc_column_inner width=”1/6″][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row]