Background

On the 19th of August, 2019, Nigerian Electricity Regulatory Commission (NERC) issued minor tariff reviews (“2016 – 2018 Minor Review Order”) to the Multi-Year Tariff Order 2015-2024 (MYTO 2015), to take into consideration the impact of macroeconomic variables on the existing tariff between the years 2016 and 2018. Additional minor reviews were carried out in December 2019 and issued on the 3rd of January, 2020 (the “Order”).

Both reviews were made pursuant to sections 32 and 76 of the Electric Power Sector Reform Act, 2005 and NERC’s powers set out in Paragraph 17 of MYTO 2015, which provides that: “NERC will continue to review the Disco’s tariff bi-annually as part of the minor review. It provides that NERC will vary the Disco’s tariffs during minor reviews if there is a material change in the inflation rate, exchange rate and generation capacity used in the derivation of the Disco’s tariffs.”

Key Points in the 2016–2018 Minor Review Order

- The 2016–2018 Minor Review Order reflects the impact of changes in macroeconomic variables, such as inflation, exchange rate, gas prices, capital expenditure allowance for Transmission Company of Nigeria, among other considerations, during the 2016–2018 period in determining cost-reflective tariffs and revenue shortfalls (Section 6, 2016–2018 Minor Review Order).

- It sets each Distribution Company’s (Disco) minimum remittance to the Nigerian Bulk Electricity Trading Plc (NBET) and the Market Operator (MO) for 2019.

It recognizes the years 2017 and 2018 as years of mutual non-performance to account for uncertainties on cost-reflective tariffs and

Image courtesy thorusengenharia.com.br

Image courtesy thorusengenharia.com.br

- revenue recovery. Therefore, Aggregated Technical and Commercial (AT&C) loss improvement targets will not apply in computing tariffs and relevant revenue deficit/surplus in the respective years. In this regard, the provisions for capital expenditure for the years of non-performance have been netted-off the revenue requirement of Discos (Section 9(c) 2016–2018 Minor Review Order).

- It mandates all Discos to meter all Federal Government of Nigeria’s (FGN) Ministries, Departments and Agencies (MDA) with appropriate meters of their choice within 60 days from its effective date. It also grants all Discos the right to disconnect any MDA defaulting in the payment for electricity (Section 11, 2016–2018 Minor Review Order).

- It proposed that cost-reflectivity would be achieved by July 2020 (Section 13, 2016–2018 Minor Review Order).

Please note, however, that the Order has superseded the previous Orders on this subject matter. As a result, some of the highlights provided above are no longer effective, for example, the one on achieving cost-reflectivity by July 2020.

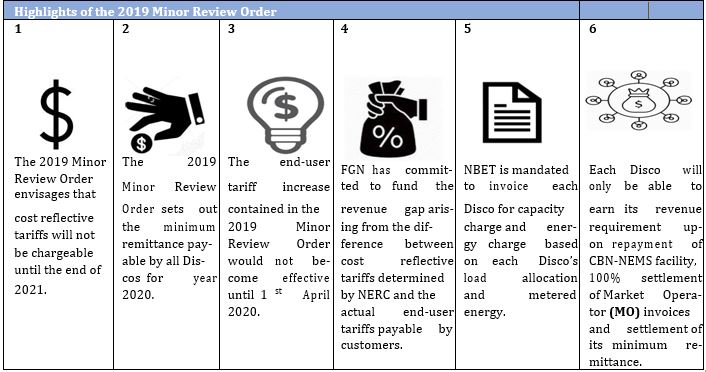

Highlights of the Order

The Order was issued to reflect the impact of changes in the minor review variables in the determination of cost-reflective tariffs and relevant tariff and market shortfalls for the years 2019 to 2020 (Section 5 Order). The Order also sets out the minimum remittance payable by the Discos to NBET and the rest of the market for 2020 based on the allowed tariffs.

Below are the highlights of the Order:

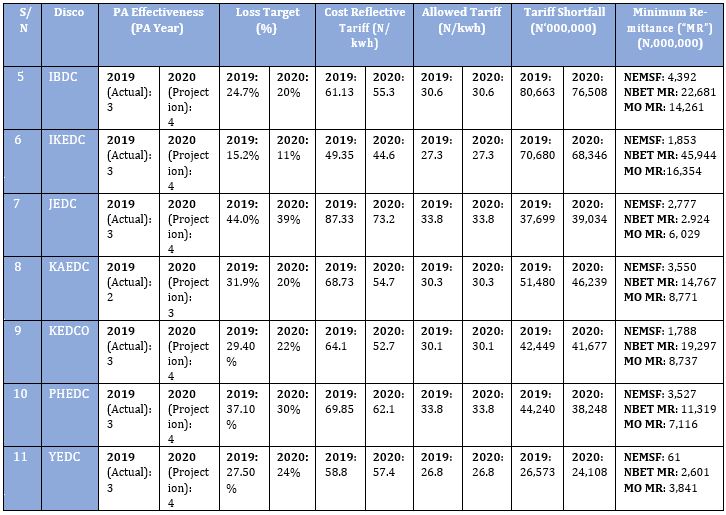

The Order also provides a summary of the minor review assumptions made for 2019 and projections for 2020 as well as minimum remittance threshold, which varies from Disco to Disco. The key minor review assumptions and minimum remittance threshold are set out in the table below. Full details of the Minor Review Order for all Discos can be accessed at nerc.gov.ng.

It is pertinent to note that in support of the Order, NERC issued an Order on Transitional Accounting of Tariff Related Liabilities (the Transitional Accounting Order) on the 28th of January 2020. The Transitional Accounting Order provides that upon payment of the minimum remittance by the Discos as provided in the Order and set out in the table above, the deferred payment portion, being the tariff-related balance of the invoices issued by NBET, will be offset by NBET on a draw down from the multiple funding sources in the Power Sector Recovery Programme (PSRP) financing plan. It further provides that the non-tariff-related portion of NBET’s invoice will be recovered by NBET through the payment guarantees provided by each Disco.

The Transitional Accounting Order aims to settle the continued accrual of tariff-related liabilities in the financial records of the Discos during the transition to a cost-reflective tariffs. The primary objectives of the Transitional Accounting Order are to:

- provide a guideline for the transitional accounting treatment of tariff-related liabilities in the financial records of market participants;

- ensure that no new tariff-related liabilities accrue in the financial records of the Discos;

- maintain the creditworthiness of the balance sheet of Discos for the purpose of raising capital for improved electricity networks and service delivery.

Consequently, if the Discos committedly pay the minimum remittance amount and the tariff-related and non-tariff-related balance of NBET invoices are defrayed as provided in the Order and the Transitional Accounting Order, the financial condition of the Discos and the larger Nigerian Electricity Supply Industry (NESI) market could receive a much-needed boost.

Implications of the Order on the Nigerian Electricity Supply Industry

Tariffs to remain non-cost-reflective until end of 2021: The 2016-2018 Minor Review Order had envisaged a migration to a cost-reflective tariff by July 2020. However, following the issuance of the Order, cost-reflective tariffs for the Discos are now expected by the end of 2021. The impact of this is that Discos will continue to struggle to meet their revenue requirements, minimum

- remittance and operational costs. Particularly since there’s now increased pressure to meet minimum remittance requirements or face penalties from NERC.

- FGN to fund revenue gap: Further to the provisions of the PSRP, the FGN has, by the Order, committed to funding the gap between the allowable tariffs that is currently chargeable by the Discos and the cost-reflective tariffs, which Discos can only start to collect in 2021. The intention of the FGN is to allocate the revenue gap to paying the other participants in the value chain and gas suppliers on the premise that the Discos will also meet their minimum remittances. This will ensure that the Discos do not continue to carry tariff shortfalls and debts on their books. It is, however, unclear how some of the historical tariff shortfalls post-MYTO 2015 will be allocated.

- The Order will require more efficient operations from Discos: Given the conditions placed on each Disco to meet its revenue requirement, including making minimum remittances alongside other obligations (as stated above), Discos would now as a necessity have to improve on their operational efficiency such as effective metering of customers and improved collections. We are likely to see improved efficiencies and Discos creating franchises over their high-paying areas to reduce losses, improve reliability and increase collections in order to generate adequate cashflow to enable them stay afloat prior to the commencement of the cost-reflective tariffs regime.

- Disco insolvency likely to become more apparent prior to cost-reflectivity: The current financial states of the Discos and their financial obligations in the NESI, may mean that the insolvency of the Discos would become more apparent before cost-reflective tariffs come into effect.

Embedded generation projects intending to supply power to Discos must consider MYTO tariff projections: Another impact of the Order is that Embedded Generation (EG) projects (Independent power being supplied to Disco networks or franchise areas) intending to benefit from a cost-reflective tariffs by July 2020 as initially provided and envisaged under the 2016–2018 Minor Review Order (Section 13 2016–2018 Minor review Order), would have to re-adjust their projections. Therefore, EG project developers looking to sell power to the Discos as offtakers

Image courtesy businessday.ng

- would have to consider the viability of developing the project based on the current allowable tariffs, given that cost-reflective tariffs cannot be charged until the end of 2021 (Section 10 Order ).

Notwithstanding this, it should be noted that by the provisions of Paragraph 15 of the MYTO 2015, EG developers may, subject to NERC’s prior approval, negotiate a higher tariff with the Discos.

On the other hand, projects under development in anticipation of cost-reflective tariffs coming into effect in 2021 may start projecting and negotiating based on the cost-reflective tariffs. This is provided that the set 2021 timeline for the operation of the cost-reflective tariff is not extended to a further date.

- The R1 Tariff Category Will Remain Unchanged: Under the Order, the N4 tariff payable by customers in the R1 category of residential customers will remain unchanged from 2015–2024. This means that this category of customers will not be paying cost-reflective tariffs even after cost-reflective tariffs becomes effective by the end of 2021.

This does not appear to be incentivizing for the Discos and may make Discos reluctant to deliver power to these categories of customers. It is clear from the provisions of the Order that the FGN will fund the difference between the allowable tariffs and the cost-reflective tariffs until cost-reflective tariffs becomes effective at the end of 2021. However, the Order does not state if the funding gap that will be created by the R1 customers paying N4 even after the cost-reflective tariffs becomes effective will also be funded.

Reactions to the Issuance of the Order

The tariff review contained in the Order has sparked reactions from various stakeholder across the

nation. These include both governmental authorities and non-government organizations.

For instance, in response to the issuance of the Order, the Incorporated Trustees of Human Rights Foundation made an ex-parte application at the Federal High Court (the Court) seeking an interim injunction against the implementation of new electricity tariffs. However, this application was declined by the Court, which ordered parties to maintain status quo pending the hearing of the motion on notice. (Punch newspaper, January 7, 2020)

It is pertinent to note that the Order intends that the change in tariff should become effective by April 2020. This will enable customers to continue making payments based on of the existing chargeable tariffs pending when the status quo is allowed to change by a competent court. However, payment of the existing tariffs by customers may continue if the court rules in favour of the Human Right Foundation.

Furthermore, the House of Representatives also directed the Ministry of Power and the NERC to suspend plans to increase electricity tariffs until the leadership of the legislative chamber concludes consultations on the matter. (Order Paper, January 14, 2020)

Conclusion

While the increase in tariffs by these Minor Review Orders will be considered a welcome development by market participants, it is expected that the end consumers who are yet to see any remarkable change in electricity generation, transmission and distribution post-privatization will query the basis for these incremental reviews at this time. In any case, some of the relevant macroeconomic variables (e.g. exchange rate of N309.90 per USD1 and gas price of USD2.50MMBTU) that form the building block for the new tariff are not realistic. For instance, it is expected that the Discos will incur some of the capital expenditure allocated to them under the Order in procurement of equipment abroad. By so doing, they may be unable to source for foreign exchange at the official rate of N309.90 to USD1. The rate at the parallel market where foreign exchange is more readily available, is N360 to USD1.

NERC’s renewed commitment to implementing the minor tariff reviews as envisaged under the 2015 MYTO and the FGN’s commitment to fund the difference between the allowable tariffs and the cost-reflective tariffs prior to the cost-reflective tariffs coming into effect by the end of 2021, will provide a form of relief to the revenue strain currently being experienced in the NESI. However, given the extent of insolvency in the NESI, more drastic and wholistic approaches would be required from various stakeholders, particularly the Discos, to improve their current financial condition and that of other market stakeholders.

Issues such as lack of adequate metering of customers and the general inefficiencies associated with the Discos must also be aggressively tackled to improve the financial situation of the NESI.

Given the extent of insolvency in the NESI, more drastic and wholistic approaches would be required from various stakeholders, particularly the Discos, to improve their current financial condition and that of other market stakeholders.

Detail Commercial Solicitors is distinct as Nigeria’s first commercial solicitor firm to specialize exclusively in non-courtroom practice. Based in Lagos, Nigeria’s business capital, DETAIL is totally committed to its clients’ business objectives and reputed for dealing with the minutiae. www.detailsolicitors.com